Kotak Mahindra Mutual Fund launches Midcap 50 ETF Scheme

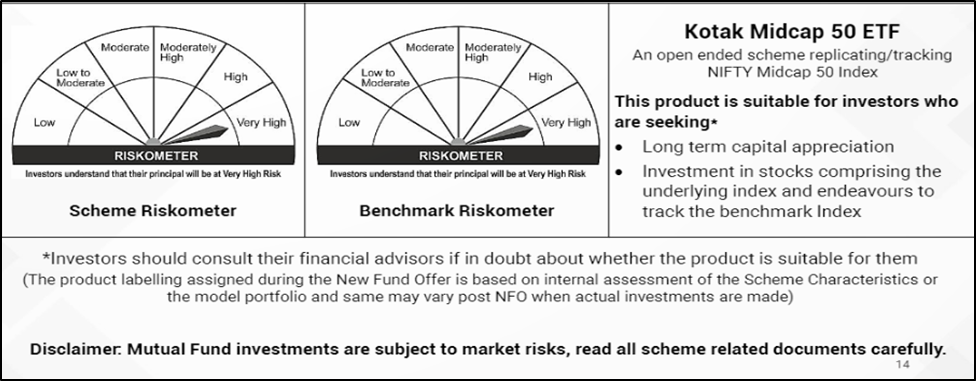

Mumbai, 6th January, 2022: Kotak Mahindra Asset Management Company Ltd (Kotak Mahindra Mutual Fund) today announced the launch of an Exchange Traded Fund – Kotak Midcap 50 ETF – an open ended scheme that will track the Nifty Midcap 50 Index.

The new fund offering (NFO) is benchmarked against the Nifty Midcap 50 Index (TRI), which captures the movement of the mid-cap segment of the market. Since 2004, in 11 out of 18 years, the Nifty Midcap 50 Index has performed better than both Nifty 50 and Nifty 500. Additionally, Nifty Midcap 50 has given a CAGR return of 44.9% year-to-date compared to 25.6% for Nifty 50 and 31.6% for Nifty 500. (Source: NSE)

The Kotak Midcap 50 ETF will replicate the Nifty Midcap 50 Index, which includes the top 50 companies based on full market capitalisation from Nifty Midcap 150 Index with preference given to those stocks on which derivative contracts are available on the National Stock Exchange. In case 50 midcap stocks do not have derivatives contract available on them then it could have less than 50 stocks in the index.

Nilesh Shah, Group President and Managing Director, Kotak Mahindra Asset Management Co. Ltd said, “Kotak’s Midcap 50 ETF scheme is a good choice for investors looking to complement or diversify their active fund investments through passive funds. With the economy on the mend over the past one year, many midcap firms have improved their performance during this period and are expected to deliver better returns going ahead, which would augur well for investors in the medium to long term. Further, with valuations of the underlying index having eased over the last few months following the recent bouts of correction in the broader market, this is an opportune time to invest in the Kotak Midcap 50 ETF.”

The scheme opens for subscription on January 6, 2022 and closes on January 20, 2022. Investors can invest a minimum amount of Rs 5,000 during the NFO period.

Mumbai, 6th January, 2022: Kotak Mahindra Asset Management Company Ltd (Kotak Mahindra Mutual Fund) today announced the launch of an Exchange Traded Fund – Kotak Midcap 50 ETF – an open ended scheme that will track the Nifty Midcap 50 Index.

The new fund offering (NFO) is benchmarked against the Nifty Midcap 50 Index (TRI), which captures the movement of the mid-cap segment of the market. Since 2004, in 11 out of 18 years, the Nifty Midcap 50 Index has performed better than both Nifty 50 and Nifty 500. Additionally, Nifty Midcap 50 has given a CAGR return of 44.9% year-to-date compared to 25.6% for Nifty 50 and 31.6% for Nifty 500. (Source: NSE)

The Kotak Midcap 50 ETF will replicate the Nifty Midcap 50 Index, which includes the top 50 companies based on full market capitalisation from Nifty Midcap 150 Index with preference given to those stocks on which derivative contracts are available on the National Stock Exchange. In case 50 midcap stocks do not have derivatives contract available on them then it could have less than 50 stocks in the index.

Nilesh Shah, Group President and Managing Director, Kotak Mahindra Asset Management Co. Ltd said, “Kotak’s Midcap 50 ETF scheme is a good choice for investors looking to complement or diversify their active fund investments through passive funds. With the economy on the mend over the past one year, many midcap firms have improved their performance during this period and are expected to deliver better returns going ahead, which would augur well for investors in the medium to long term. Further, with valuations of the underlying index having eased over the last few months following the recent bouts of correction in the broader market, this is an opportune time to invest in the Kotak Midcap 50 ETF.”

The scheme opens for subscription on January 6, 2022 and closes on January 20, 2022. Investors can invest a minimum amount of Rs 5,000 during the NFO period.